georgia film tax credit history

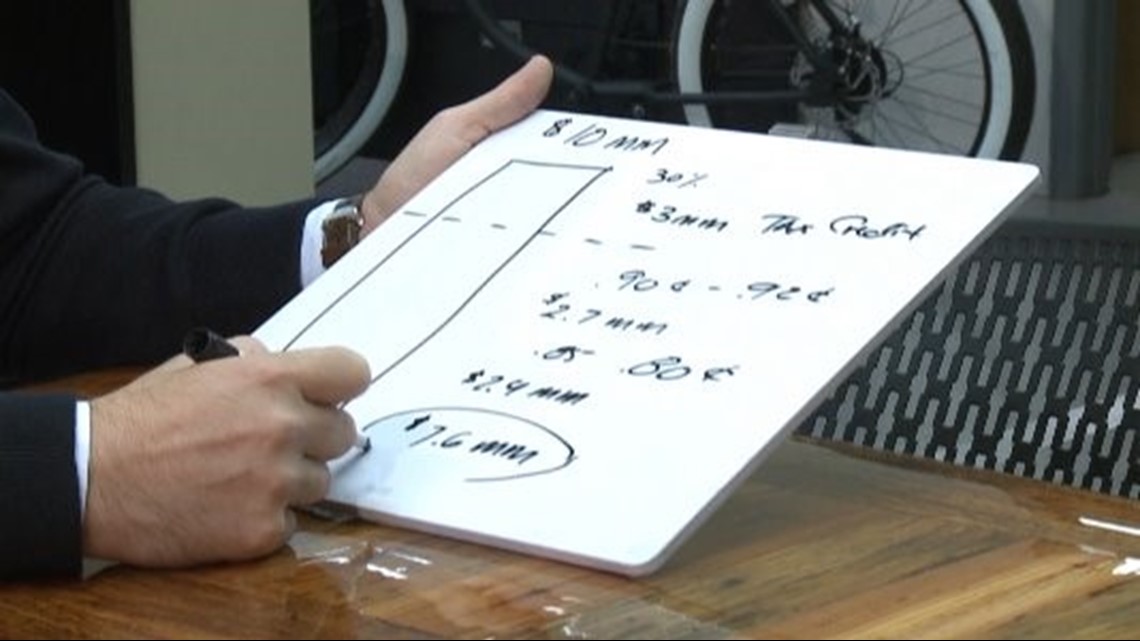

The figure is 40 higher than the states. 20 base transferable tax credit.

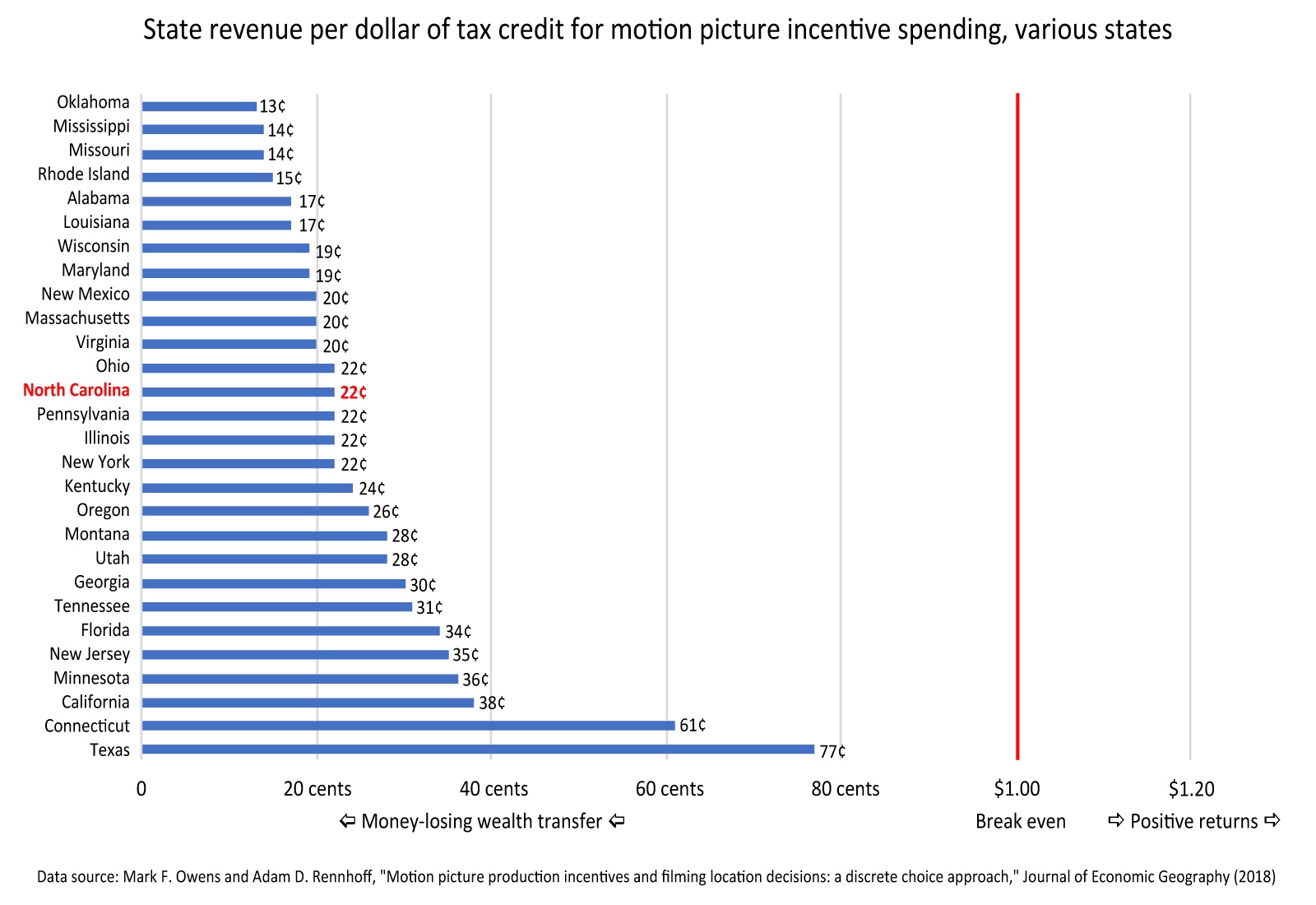

What Do Film Incentives Mean For The North Carolina Economy Center For The Study Of Free Enterprise

Many are unaware of this but Georgia is known as the Hollywood of the South because of all the film.

. Georgias film tax credit is popular among those working in the film industry but it comes with a considerable cost according to the AJC report. An additional 10 credit is given for placing a Georgia logo in your film title or. About the Film Tax Credit First passed in 2005 Georgias film tax credit provides an income tax credit to.

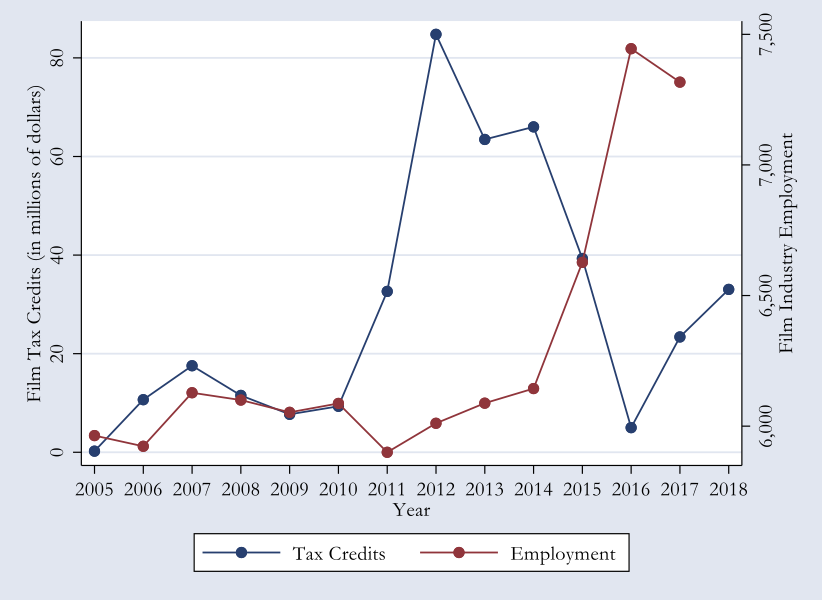

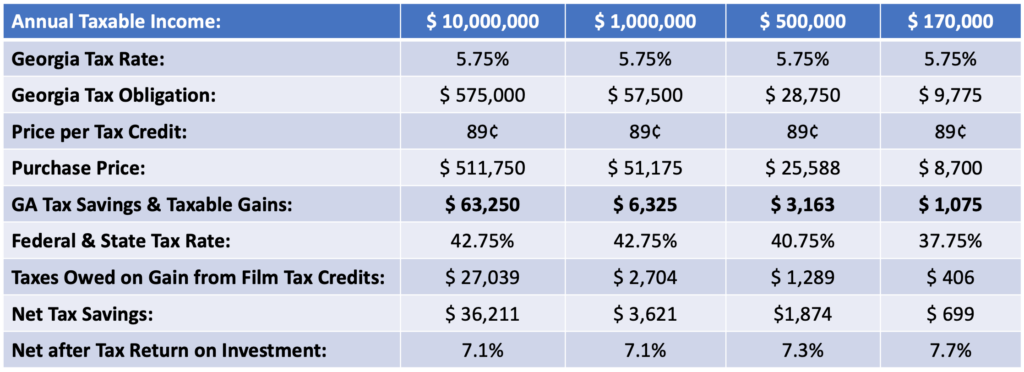

So for example if you. The tax credit had grown from. For example you could purchase 20000 of 2017 Georgia Entertainment Credits for 17400 resulting in an immediate savings of 2600.

September 8 2020. EUE Screen Gems offers a 6 decade history of making film television and also commercial projects of the best quality. Just in the fiscal year 2017 film and TV production had an economic impact in Georgia of 95 billion while industry sources claim that the tax subsidy costs the state 141 million 2010.

The tax credit had grown from 141. Important Changes to the Georgia Film Tax Credit. An audit is required prior to utilization or transfer of any earned Georgia film tax credit that exceeds 25 million in 2021 125 million in 2022 and for any credit amount thereafter.

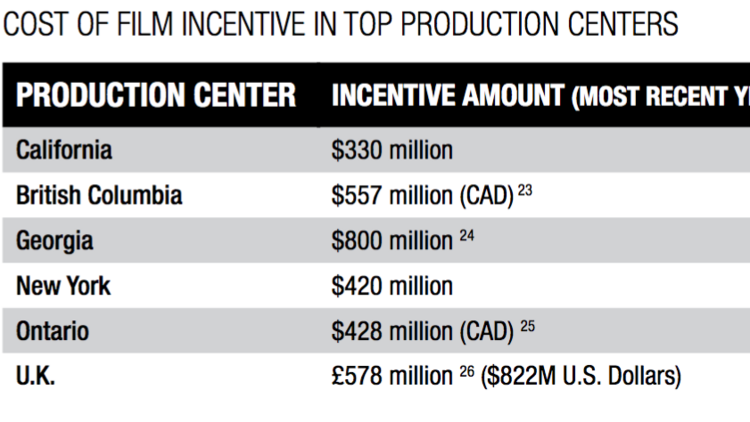

Productions that qualify receive a 20 tax credit. Georgia doled out a record 12 billion in film and TV tax credits last year far surpassing the incentives offered by any other state. GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 base transferable tax credit the Georgia Department of Economic Development must certify the project.

20 base transferable tax credit. About the Film Tax Credit First passed in 2005 Georgias film tax credit provides an income tax credit to production companies that spend at least 500000 on qualified. Georgia is a production-friendly state with transferable film tax credits up to 30 of qualified expenditures.

A Georgia taxpayer may purchase Georgia. Georgias film tax credit is popular among those working in the film industry but it comes with a major cost according to the AJC report. Some Georgia film tax incentives include.

Of the film tax credit 18-03A was released earlier this month. Georgias Entertainment Industry Investment Act provides a 20 tax credit for filming and entertainment industries that spend 500000 or more on production and post.

Movie Production Incentives In The United States Wikipedia

Why Most Filmmakers Sell Off Their Georgia Tax Credits 11alive Com

Essential Guide Georgia Film Tax Credits Wrapbook

Buyers Os State Film Tax Credits

Audit Georgia S Return On Investment For Its Film Tax Credit Was 10 Cents On The Dollar

Georgia Film Tax Credits Cabretta Capital

Georgia Film And Tv Tax Credit Jumps To A Record 1 2 Billion Variety

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

How Oprah Walmart Scored Tax Breaks On Films That Others Made

Consider These Georgia Film Locations For Production Destination Film Guide

Piecing Together Georgia S Post Production Tax Break Ecg Productions

Georgia Film Industry Leaders Believe Tax Incentives Are Crucial To Continued Success Atlanta Business Chronicle

Georgia Film Production Tax Credits During 2020 Election Indiewire

Arizona Bill Would Create Tax Credits For Film And Tv Productions

Audits Becoming Mandatory For Georgia S Film Tax Credit Mauldin Jenkins

Analysis Georgia S Film And Tv Incentives Could Become Part Of A 2020 Budget Battle

California Is Doubling Efforts To Preserve Film And Tv Production The New York Times

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle

Georgia Touts Record 2 9 Billion In Direct Film Tv Spending In Fy2019